When a doctor writes a prescription, they’re not just choosing a medicine-they’re making a financial decision too. In the U.S., generic drugs make up 90.5% of all prescriptions filled, but they account for only about 23% of total drug spending. That gap is why health systems, insurers, and government programs have started paying providers to prescribe generics. It’s not about cutting corners. It’s about aligning incentives with real savings-when it’s safe to do so.

How Incentives Actually Work

Generic prescribing incentives aren’t one-size-fits-all. Some are simple: a physician gets a $5 bonus for every generic prescription in a high-cost class like statins or blood pressure meds. Others are more complex: a clinic might earn a $5,000 annual bonus if 80% of eligible prescriptions are generic. Blue Cross Blue Shield plans, for example, have been using this model since 2020, with providers in some states reporting $2,000-$4,000 extra per year just from switching to generics where appropriate.

But money isn’t the only tool. Non-financial rewards matter too. Providers who consistently choose generics often get faster prior authorizations, priority scheduling for patient appointments, or even public recognition in their health system’s newsletter. One practice in Minnesota started posting a monthly “Generic Champion” board-no cash, just a photo and a coffee gift card. Within six months, generic prescribing in that clinic jumped by 19%.

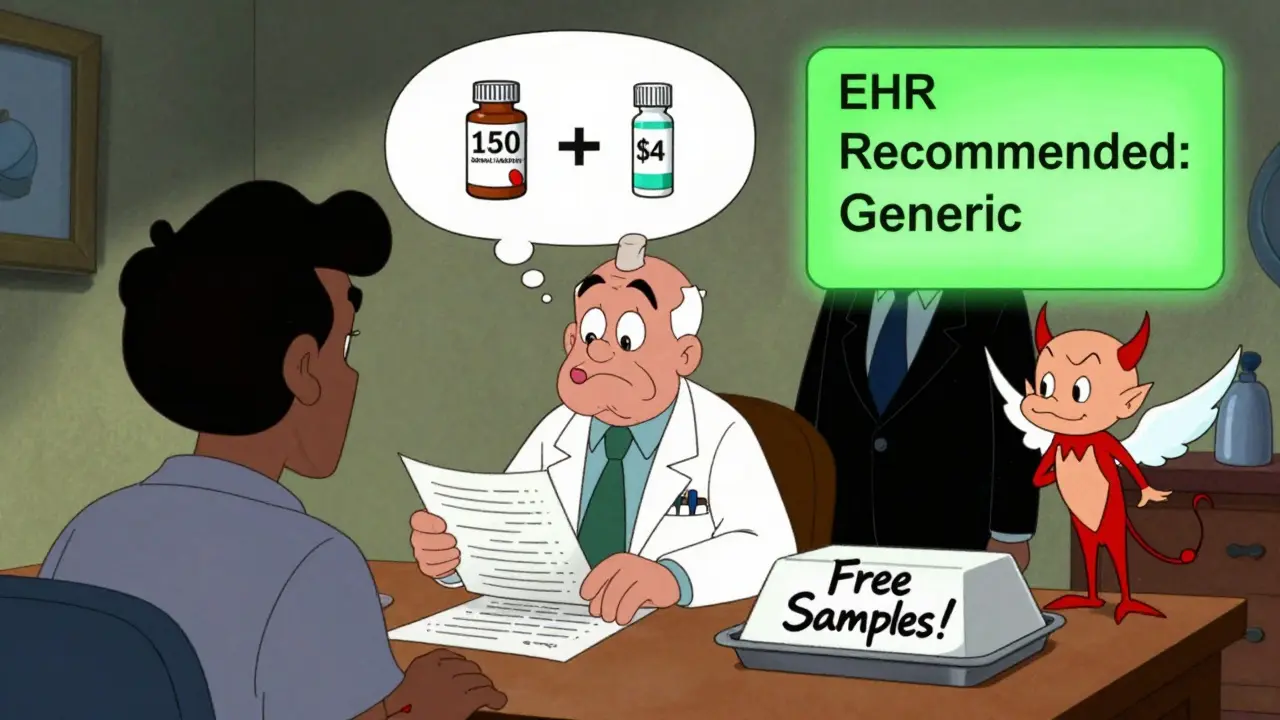

Electronic health records (EHRs) now play a big role. Many systems have a “generic-first” default setting. When a doctor types in a brand-name drug, the EHR automatically suggests the generic equivalent. A 2020 Duke University study found this simple change increased generic prescribing by 22.4 percentage points. No extra work. No bonus. Just a smarter interface.

What’s Working-and What’s Not

Not all incentive programs deliver the same results. Formulary tiering-where insurers make generics cheaper for patients-is common, but it only nudges providers a little. A 2022 ASPE report showed it raised generic use by just 8-12%. Why? Because the patient pays less, but the provider doesn’t get anything extra.

Direct provider incentives? They work better. UnitedHealthcare’s Value-Based Prescribing Program, which ties bonuses to both generic use and clinical outcomes, boosted generic prescribing by 24.7% in primary care clinics. The key? It wasn’t just about cost. It was about quality. Providers had to document why a brand was necessary if they skipped the generic. That stopped lazy prescribing.

But here’s the catch: incentives can backfire. A 2023 JAMA Health Forum study found that doctors who work with 340B drug discount programs-usually safety-net clinics-actually prescribed 6.8% fewer generics than others. Why? Because those clinics get big discounts on brand-name drugs. So, the incentive to save money disappears. In fact, it becomes cheaper for them to use the brand.

Even more troubling: pharmaceutical companies still find ways to influence prescribing. A 2022 study showed physicians who received free meals, travel, or equipment from drug reps were 37% less likely to always choose generics-especially for new generics still under patent. The relationship between money and medicine is still too tangled.

Provider Voices: The Real Story

Doctors aren’t just numbers in a spreadsheet. Their feedback is messy, real, and revealing.

Dr. Michael Chen, an internal medicine physician in California, told Sermo: “The UnitedHealthcare incentive added about $2,800 to my income last year. I didn’t have to change anything. The EHR did the work.”

But Dr. Sarah Williams, a family doctor in Texas, had a different experience: “Some programs feel like coercion. What if my patient has an allergy? Or a rare reaction? The system doesn’t care. It just wants the generic.”

On Reddit, a user named MedDoc2020 wrote: “Generic incentives work great for high blood pressure or diabetes. But when someone has five chronic conditions and a history of bad reactions? You can’t just pick the cheapest pill. You need to think.”

A 2021 MGMA survey found that 63% of providers liked incentives when they were voluntary and tied to quality. But 78% worried that if patients found out their doctor was being paid to prescribe generics, trust would erode. That’s a real risk. Patients don’t want to feel like a cost-saving metric.

What’s Changing in 2025 and Beyond

The game is shifting. In 2023, CMS expanded its “$2 Drug List” to more Medicare Advantage plans. For essential generics-like metformin, lisinopril, or atorvastatin-the patient pays just $2 per prescription. That simple move increased adherence for chronic conditions by 22.7%.

The Inflation Reduction Act of 2022 also cracked down on drug patents, making it easier for generics to enter the market. Experts predict this alone will raise generic use by another 5-7% by 2027.

UnitedHealthcare is rolling out “value-based prescribing contracts” in 2024. These don’t just reward generic use-they reward good generic use. If a patient’s blood pressure improves and stays stable on a generic, the provider gets paid more. If it doesn’t? They get feedback, not a penalty. It’s a move toward outcomes, not just volume.

By 2028, the IMS Institute predicts 94% of prescriptions will be generic. That’s up from 90.5% today. But getting there won’t be easy. The biggest hurdles? EHR systems that still don’t talk to each other, and providers who feel like they’re being forced into cookie-cutter medicine.

What Makes a Good Incentive Program?

Based on real-world results, here’s what works:

- Don’t punish exceptions. If a patient needs a brand because of an allergy, a rare condition, or bioavailability issues, the system should let the provider choose it without penalty.

- Make it easy. Default settings in EHRs, automatic substitution alerts, and pre-approved formularies reduce friction.

- Focus on quality, not just cost. Tie incentives to outcomes-like adherence, hospitalization rates, or lab results-not just the number of generics written.

- Don’t tell patients. Disclosing provider bonuses risks eroding trust. The goal is better care, not a transparency exercise.

- Train providers. Most doctors need 8-12 hours of training to understand formularies, therapeutic alternatives, and how to use EHR tools effectively.

Germany’s system-where the government sets a reimbursement price for every drug class based on the cheapest generic-is often cited as the gold standard. They hit 93% generic use. The U.S. is at 90.5%. We’re close. But we’re still missing the discipline.

Final Thought: It’s Not About Cheap-It’s About Smart

Generic drugs aren’t “lesser.” They’re the same active ingredient, same safety profile, same effectiveness. The only difference? Price. And that price difference is massive. A 30-day supply of lisinopril costs $4 as a generic. As a brand? $150. That’s not a choice-it’s a mistake waiting to happen.

The real challenge isn’t convincing doctors to prescribe generics. It’s designing systems that don’t accidentally reward the wrong behavior. Incentives can help. But only if they’re smart, flexible, and rooted in clinical reality-not just balance sheets.

Do generic prescribing incentives compromise patient care?

Not when they’re designed well. Studies show that generic drugs are just as safe and effective as brand-name drugs. The problem isn’t the generics-it’s poorly structured incentives that ignore clinical nuance. Programs that allow exceptions for patients with allergies, rare conditions, or complex medication histories avoid this risk. The best systems use clinical decision support, not rigid rules.

How much money can a provider earn from generic prescribing incentives?

It varies. Some providers earn $5-$15 per generic prescription in targeted drug classes. Annual bonuses can reach $3,000-$5,000, especially in high-volume practices. One 2022 survey of primary care physicians found that those in incentive programs earned an average of $2,800 extra per year, with no significant increase in workload.

Are generic prescribing incentives only used in the U.S.?

No. Germany’s reference pricing system-where the government sets a single reimbursement rate for all drugs in a therapeutic class-is one of the most effective. It’s led to 93% generic use. The UK, Canada, and Australia also use variations of provider incentives, though they’re often tied to national health budgets rather than private insurers. The U.S. is unique in its heavy reliance on private payer-driven models.

Why do some doctors resist these incentives?

Many feel it undermines their clinical judgment. A 2023 AMA survey found 52% of providers who rejected incentive programs cited loss of autonomy as the main reason. Others worry about “cookie-cutter” care-where complex patients are forced into one-size-fits-all prescriptions. The most successful programs address this by allowing exceptions, offering education, and involving providers in designing the rules.

Do pharmaceutical companies influence these programs?

Yes. While incentives are meant to push providers toward generics, drug companies still spend billions on marketing, free samples, and educational events. A 2022 study found that physicians who received any form of industry support were 37% less likely to prescribe generics, especially for new drugs. This creates a conflict: one system rewards cost-saving, while another rewards brand loyalty.

Generic prescribing incentives are here to stay. The question isn’t whether they work-it’s whether we can make them fair, smart, and truly patient-centered. The answer will shape how we pay for care for the next decade.

christian jon

February 13, 2026 AT 06:18Suzette Smith

February 13, 2026 AT 21:30Autumn Frankart

February 14, 2026 AT 02:28Skilken Awe

February 14, 2026 AT 04:51andres az

February 14, 2026 AT 07:25Steve DESTIVELLE

February 14, 2026 AT 12:50Stephon Devereux

February 15, 2026 AT 11:36Carla McKinney

February 15, 2026 AT 15:11Ojus Save

February 17, 2026 AT 01:24Jack Havard

February 18, 2026 AT 08:40Gloria Ricky

February 18, 2026 AT 12:53